The main accounts within your COA help organize transactions into coherent groups that you can use to analyze your business’s financial position. In fact, some of the most important financial reports — the balance sheet and income statement — are generated based on data from the COA’s main accounts. This structured approach allows for systematic recording and reporting, making it easier to track financial activity and prepare financial statements. Each account in this example can be further detailed or expanded based on the specific needs of the business, such as adding separate accounts for different types of services or inventory. The COA is usually hierarchical, with accounts organized in categories and subcategories.

Free Course: Understanding Financial Statements

- Setting up a chart of accounts (COA) is a critical step for any business to effectively manage its financial records.

- Business needs and regulations change over time, so it’s important to review your COA periodically to ensure it continues to meet your business requirements.

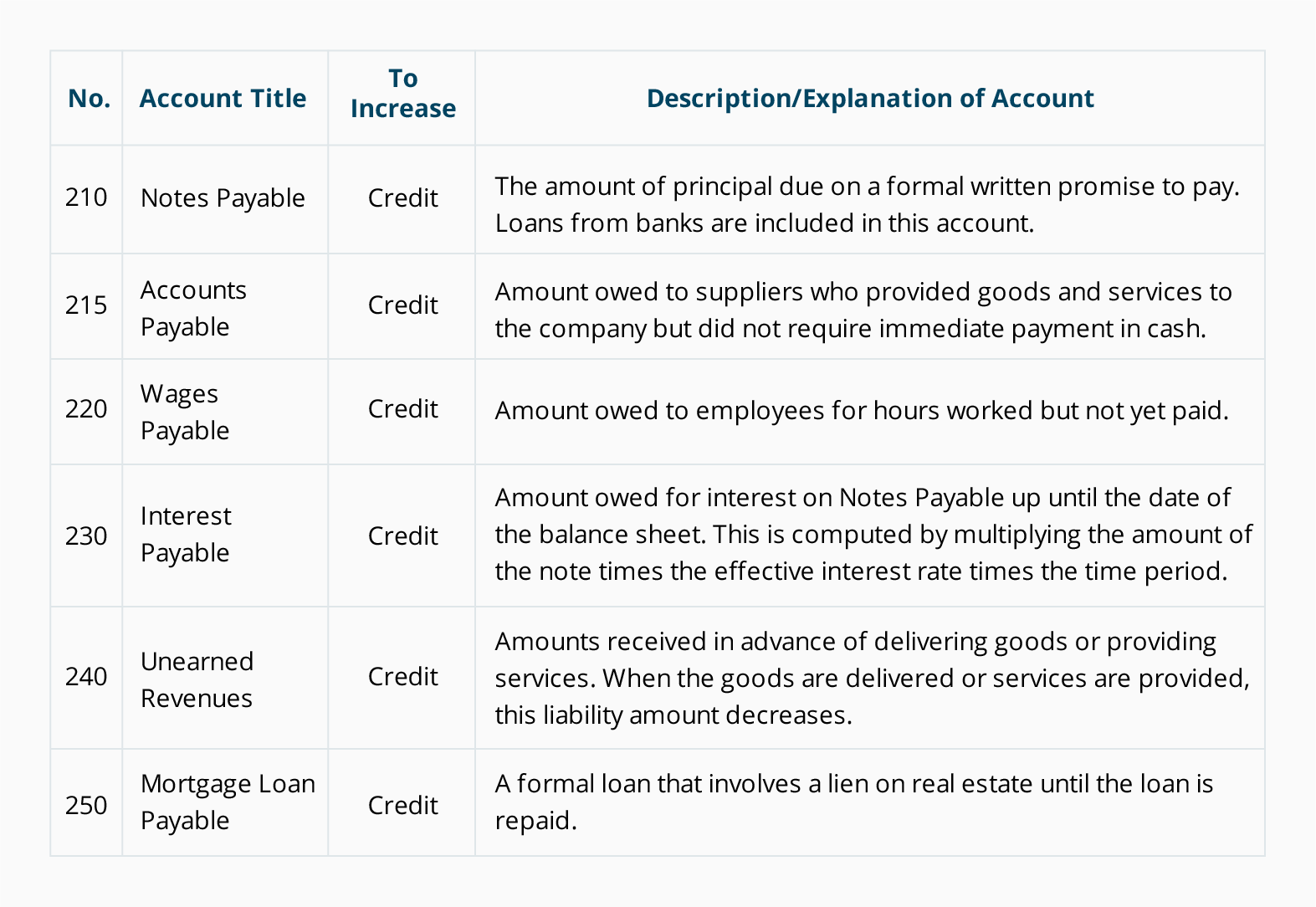

- Those that start with two, three, four, and five represent liability, equity, revenue, and expense transactions, respectively.

- This way, whether you’re setting up restaurant bookkeeping or ecommerce accounting, you follow the standard chart of accounts.

- Essentially, if you placed the statements of financial position and performance on top of each other, you would come up with the chart of accounts.

- Size – Set up your chart to have enough accounts to record transactions properly, but don’t go over board.

The company records each transaction (journal entry or accounting entry) in the general ledger account, and the general ledger totals create the trial balances. A chart of accounts (COA) is a structured list of an organization’s financial accounts used to categorize and record financial transactions. It serves as the backbone of an accounting system, providing a framework for organizing financial data in a logical manner. The COA is tailored to an organization’s needs and can vary widely in complexity. A chart of accounts is a list of all the accounts and financial transactions for your business in one location.

How HighRadius Can Help You Accelerate Your Business Growth ?

A chart of accounts is a catalog of account names used to categorize transactions and keep your business’s financial history organized. The list typically displays account names, details, codes and balances. There’s often an option to view all the transactions within a particular account, too. Small businesses may record hundreds or even thousands of transactions each year. A chart of accounts (COA) is a comprehensive catalog of accounts you can use to categorize those transactions.

Customize according to your business needs

Similar to a chart of accounts, an accounting template can give you a clear picture of your business’s financial information at a glance. Utilizing accounting tools like these will ensure a better workflow, helping you grow your company. FreshBooks offers a wide variety of accounting tools, like accounting software, that make it easier to stay organized. Here is a way to think about a COA as it relates to your own finances. Say you have a checking account, a savings account, and a certificate of deposit (CD) at the same bank. When you log in to your account online, you’ll typically go to an overview page that shows the balance in each account.

For each category (i.e. revenue, COGS, OPEX) designate a starting number. For example, all revenue accounts will start with 4, all COGS with 5, and all OPEX with 6. Take note, however, that the chart of accounts vary from company to company. The contents depend upon the needs and preferences of the company using it. You would debit the cash account $1,000 and credit the revenue account $1,000 on the charts of the account.

Part 2: Your Current Nest Egg

This column shows the financial statement in which the account appears, and for a profit making business is either the balance sheet of the income statement. The specific accounts and their numbering may vary by company, industry, or specific accounting standards adopted. Regular updates to the COA may be necessary to reflect changes in the business structure or accounting requirements. Gains and losses represent the money earned or lost from activities outside the company’s primary operations. For example, gains from the sale of assets or investments or losses from currency exchange fluctuations.

You don’t need a separate account for every product you sell, and you don’t need a separate account for each utility. COAs are typically made up of five main accounts, with each having multiple subaccounts. Most QuickBooks Online plans, for example, support up to 250 accounts. The average small business shouldn't have to exceed this limit if its accounts are set up efficiently. QuickBooks Online automatically sets up a chart of accounts for you based on your business, with the option to customise it as needed. The account name is the given title of the business account you’re reporting on, such as bank fees, cash, taxes, etc.

In this article you will learn about the importance of a chart of accounts and how to create one to keep track of your business’s accounts. This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit Inc. does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published.

Similarly, if you use an online program that helps you manage all your accounts in one place, like Mint or Personal Capital, you’re looking at basically the same thing as a company’s COA. Most new owners start with one or two broad categories, like sales and services, it may make sense to create seperate line items in your chart of accounts for different types of income. This is because while some types of income are easy and cheap to generate, others require considerable effort, time, and expense. The ideal candidate for this role should possess a foundational understanding of accounting principles and practices and familiarity with QBO or Xero accounting software. This individual pays attention to details, is proactive in understanding financial statements, and is willing to expand their knowledge further. A problem-solver at heart, the candidate quickly seeks assistance when needed and leverages technology to enhance efficiency and adaptability.

It makes sure that there’s a place for every financial detail, which helps in creating reports, preparing taxes, and making decisions about the future of the business. This list includes every category under which you can classify money spent or earned by your business, from the salaries paid to employees to the revenue from sales. Each category, or “account” in this list, is assigned a unique code to keep things straightforward and consistent. This makes it easier to find information and ensures that everyone in the business records transactions similarly. Having a Chart of Accounts allows businesses to easily track their financial transactions, generate meaningful financial reports, and maintain compliance with applicable regulations. It also ensures consistency in the way expenses are reported and simplifies bookkeeping tasks.

Essentially, if you placed the statements of financial position and performance on top of each other, you would come up with the chart of accounts. Now, let’s explore a couple of the COA examples mobile bookkeeping and secretarial services for businesses in various industries – online retail, manufacturing, and service businesses. We presume they accept online payments via payment platforms (for example, Stripe, Paypal, or Square).